Author Archives:

Are Physical Bitcoins Busted?

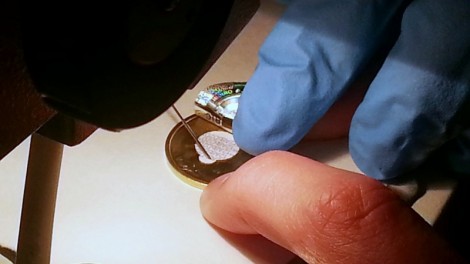

Early this month at the annual DEFCON convention, something unsettling occurred. DEFCON is an annual meeting of the minds at which the best and the brightest in the world of programming and IT come together. The focus of the convention is to discuss the state-of-the-art in technological security and vulnerability. DEFCON has often been a proving ground of sorts for tech products claiming to be secure or, even more boldly,"hacker-proof". At this year's conference one system that came under scrutiny was the much loved Physcial Bitcoin. In their attempts to break the security of the Casascius Physical Bitcoin, two white-hat hackers used a tried and true method to release the security seal on the back of the coins and reveal the hidden redemption code underneath. You can read about their methods HERE. In summary, they succeeded at obtaining the redemption codes and replacing the sticker with almost no visible evidence left behind on the "compromised" coins. What does this mean for your Titan Bitcoins? Fortunately, for Titan Bitcoin owners, there's nothing to worry about. The creators of the Titan Bitcoin saw this one coming from a mile away. That is exactly why Titan Bitcoins have a two-factor authentication system which requires an email address and password to redeem our coins. Even if you buy Titan Bitcoins from a third-party who had criminal intent to steal the value of your physcial bitcoins after the transactions was completed, you're safe. As long your coins are registered to an email address that only you have access to, you are impervious to the kind of security breach that was demonstrated at this tears DEFCON. This highlights yet another reason why its important when buying Titan Bitcoins to follow our guidelines on Buying and Selling Titans. To re-iterate the main points: 1. Scan the coin's barcode, or punch in its ID at our Verify page, to check the coin's current value. 2. Make sure the seller gives you the Coin's current registration info. 3. Change the coin's registration info as soon as you have paid for it. 4. Keep that email and password SAFE! Following these steps will ensure that your coins' value is safe and ready to be redeemed any time you need it. While it's likely to be frustrating for owners of the Casascius bitcoins that they were shown to be so vulnerable, we applaud the founder of Casascius, Mike Caldwell, for quickly implementing his own 2-factor authentication system that is offered as an added option now on his website. If there's one thing that's clear from this security breach, its that the main players in the "bitcoin game" are operating at the cutting edge of security and technology. At the Titan Mint, we stake our reputation on the security of our physical bitcoins. We welcome any feedback you have on how we can improve this process. Leave us a comment below and let us know what you think.

Bitcoin is Poised to Spike

Using traditional investment metrics to track unconventional currency is a dangerous game. Many have fallen into the trap of assigning grandiose trend calculations to financial data, only to find that they've bet hard on a big loser. However, some of the most reliable metrics on investment patterns are ones that are seasonal. Retail companies make money at Christmas time and vacation rentals go through the roof in the summertime. These seasonal changes in consumer behavior tend to have very predictable affects on the markets. There's one particular annual trend, however, that stands to make investors a ton of money this year. The bitcoin is one of the hottest commodities at the moment among investment speculators. While there are many political and social pressures driving the bitcoin into the spotlight, for investors the primary reason for all of the attention being paid to the bitcoin is its regular and often predictable price fluctuations. There is money to be made on the up-swing and the down-swing of the bitcoin price index. History has also shown that the bull markets for bitcoin can reach extreme heights and that these up-swings can be fueled by events that affect traditional markets. One of the most influential metrics for the movement of traditional investors is the Volatility index of the S&P 500, or the VIX. What is the VIX? The VIX measures the market's estimates of how wildly the prices of stocks will be fluctuating over the course of the next month. Specifically, the VIX uses an index of the call and put options that are available to calculate the movement that investors are predicting. History has shown that options traders as a whole are pretty good at predicting market movements over the short term. So why do we, the bitcoin enthusiast care about how good options traders are at predicting movements in the stock market? Simple. When the VIX goes up, investors get out. Now "Getting out" can mean a lot of things, but traditionally investors have sought opportunities outside of the stock markets when volatility is high. Gold and other precious metals have long been the benefactor of investment dollars during period of high volatility. However, an increasing number of investors are now looking towards bitcoins as the "go to" alternative investment. This means that demand for bitcoin has begun to rise when the VIX rises. When demand rises, so do the current bitcoin prices. So let's recap. Options traders are good at what they do, so we average out their thinking on market volatility to create the VIX. The movements in the VIX affect demand for investments outside of the stock market and an increasing number of investors are seeing bitcoins as an alternative investment. There's just one last piece of the puzzle that means that bitcoins are in for a spike. Remember how seasonality affects the economy. Well as a result of that seasonality and many more factors, the VIX, along with other volatility indexes like it, almost ALWAYS rises in late September or October. This is something that options traders prepare for and it something that veteran investors have banked on. The October swell in the VIX is real. If you're not sure what this means for you, then you needn't be concerned. However, for those of you looking to sell your bitcoins in the near future, you may to wait for the October swell as the price of bitcoins is almost guaranteed to rise. More and more, the bitcoin is beginning to look like a contender on the global economic stage.